Cryptocurrency and Digital Assets: Trends and Challenges

7 min read

04 Jun 2024

Cryptocurrencies and digital assets have gained significant attention and adoption in recent years, revolutionizing the financial landscape.

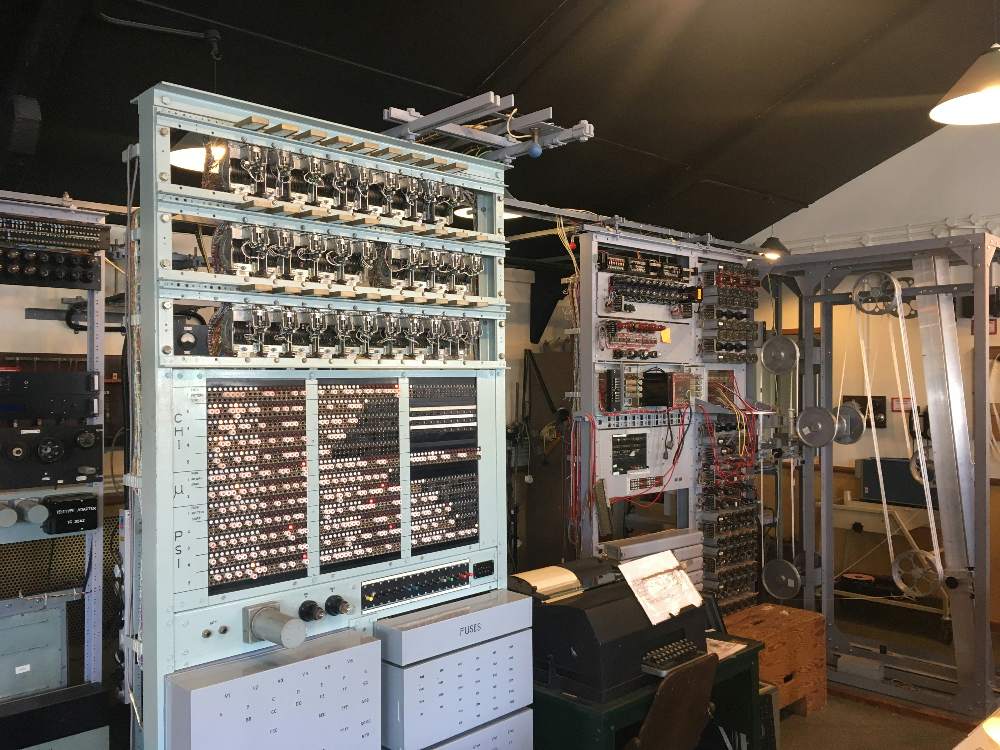

Blockchain Technology: The Foundation of Digital Assets

Blockchain technology underpins cryptocurrencies, offering decentralized and secure transactions without intermediaries.

Market Trends: Growth and Volatility

The cryptocurrency market experiences rapid growth alongside volatility, influenced by factors such as regulatory developments and investor sentiment.

Use Cases: Beyond Currency

Cryptocurrencies are expanding beyond payments to include applications in decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts, unlocking new possibilities.

Regulatory Challenges: Navigating Legal Frameworks

Regulatory frameworks vary globally, posing challenges for mainstream adoption and investor confidence in cryptocurrencies and digital assets.

Security and Privacy Concerns: Safeguarding Assets

Security measures such as cryptographic protocols and secure wallets are crucial for protecting digital assets against theft and fraud.

Future Outlook: Innovation and Adoption

Despite challenges, the future of cryptocurrencies and digital assets looks promising, with ongoing innovations and increasing institutional interest reshaping the financial landscape.

Conclusion

In conclusion, cryptocurrencies and digital assets are driving innovation in finance, presenting opportunities and challenges that will shape their role in the global economy.

More Articles

Is Blockchain the Key to Unlocking the Sharing Economy's True Potential?

5 min read | 26 Aug 2024

From Paper Trails to Permanent Records: How Blockchain is Changing History

4 min read | 25 Aug 2024

Can Blockchain Power a More Democratic Future?

7 min read | 24 Aug 2024

Will Blockchain Make Banks Obsolete?

4 min read | 23 Aug 2024

More Articles

The Next Frontier: AI & ML's Role in Climate Change Mitigation

4 min read | 07 Aug 2024

Unraveling the Black Box: Understanding Transparency in AI & ML

4 min read | 06 Aug 2024

AI Odyssey: Journeying through the Realm of Machine Learning

5 min read | 05 Aug 2024

The Quantum Leap: AI & ML Redefining Possibilities

4 min read | 04 Aug 2024